News

Tax Talk Newsletter Winter 2024

“BUDGET 2024” - TAX

POLICY ANNOUNCEMENTS

Personal tax cuts confirmed in Budget 2024

The coalition government’s first budget has been delivered against the backdrop of a declining economy

The much-anticipated detail of changes to personal tax thresholds have finally emerged. The government made no secret that tax relief was on the way f or New Zealanders, however, exactly what form those changes would take has remained a mystery until now. Touted as delivering relief to New Zealanders struggling with the cost of living, the changes to personal income tax thresholds are detailed below:

The tax relief is expected to cost $2.57 billion dollars annually and will be funded by savings, spending reprioritisation and new revenue measures.

The independent earner tax credit will be extended to an additional 420,000 people by increasing the income limit to $70,000 from 31 July 2024. Currently, those earning between $24,000 and $48,000 are entitled to the credit. The in-work tax credit will also increase by up to $50 per fortnight from 31 July 2024.

The FamilyBoost childcare rebate, which was announced ahead of the Budget, will deliver up to $75 per week to families to assist with the costs of childcare. The rebate will be administered by Inland Revenue.

The government is also boosting Inland

capabilities by committing further funding over the next 4 years. The additional funding is expected to strengthen audit activity with particular focus on the hidden economy and debt collection.

Other key announcements include:

Education

- $1.48 billion in funding to build new school and upgrade existing ones.

- new funding of $153.3 million for 35 existing and 15 new charter schools over 4 years to improve educational outcomes for students.

- $477.6 million of funding for the school lunches programme for the next 2 years

- implementation of a structured literacy programme ($67 million over 4 years).

Health

- $24 million invested over the next 4 years towards mental health counselling services for young New Zealanders.

- $1.77 billion in additional funding for Pharmac.

Housing

- additional funding of $140 million to go towards 1,500 more social houses to be provided by social housing providers, partly funded by the scrapping of the First Home Grant.

Corrections

- $1.94 billion in funding for frontline correction officers, prisoner rehabilitation programmes and increasing prison capacity

- $424.9 million towards better pay for frontline police officers and new police vehicles.

Transport

- $4.1 billion of Crown funding for the National Land Transport Fund and $1.2 billion for the new Regional Infrastructure Fund.

Defence

- the defence force will receive an additional $571 million ($163 million towards remuneration improvements and $408 million towards equipment and infrastructure upgrades).

“BUDGET 2024” - Economic outlook

“BUDGET 2024” - Economic outlook

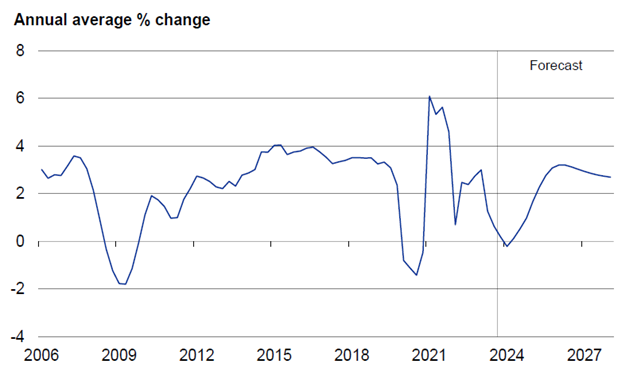

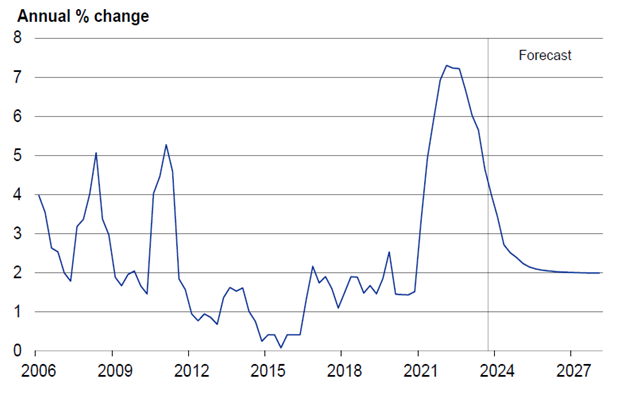

New Zealand is experiencing an economic downturn as interest rates have been increased to tackle high inflation. This downturn is deeper and more persistent than previously expected. Treasury is forecasting the economy to pick up in 2024. Its forecasts also show inflation returning to the target band of one to three per cent later this year, and interest rates falling.

Economic growth (real GDP)

CPI Inflation

“BUDGET 2024” -

“BUDGET 2024” -

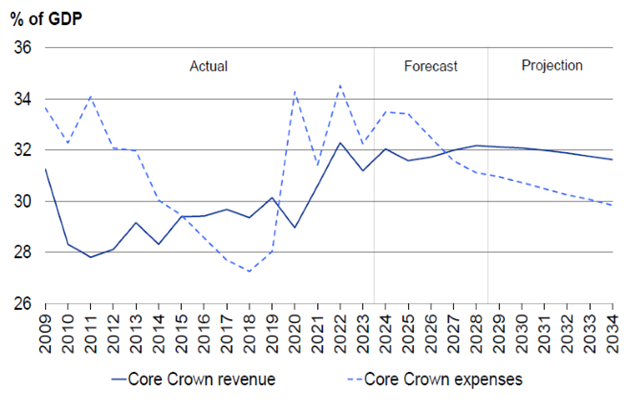

Revenue and expenses

The Government will restore discipline to spending. It has reduced the allowance for new spending in future Budgets and will ensure this spending is targeted, effective and affordable.

Fiscal discipline is long overdue, as government spending has exceeded revenue in recent years and the difference has been borrowed.

Core Crown Revenue

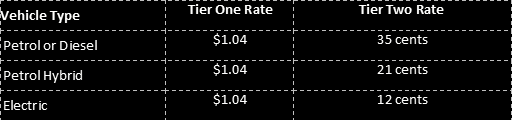

Kilometre rates for the business use of vehicles for 2024 year

The table of rates for the 2023/2024 income year for motor vehicle expenditure claims.

In accordance with DE 12(4) the Commissioner is, from time-to-time, required to set and publish kilometre rates for business customers. This is done at least once per year and the rates are set retrospectively to reflect vehicle operating costs likely incurred for the previous income year (i.e. in this item, the year ended 31 March 2024). Alternatively, business customers may choose to keep records of actual vehicle expenditure to calculate expenditure claims for the business use of a motor vehicle.

It is accepted that these rates may also be used by employers as a reasonable estimate for reimbursement of expenditure incurred by employees for the use of a private motor vehicle for business purposes in a current income year (1 April onwards), as provided in s CW 17(3)(a). However, employers are reminded that these rates are set retrospectively and may not reflect actual day-to-day motor vehicle running costs.

The rates set out below apply for the 2023/2024 income year for business motor vehicle expenditure claims. The Tier one rates reflect an overall Increase in vehicle running costs largely due to fuel costs, insurance and interest rates.

The table of rates for the 2024 income year. The Tier two rate is for running costs only. Use the Tier two rate for the business portion of any travel over 14,000 kms in a year.

Unsafe machinery costs digits and dollars

Courts have imposed more than half a million dollars in penalties since mid-March, in cases where workers have lost fingers on machinery that wasn’t kept safe by businesses.

“Businesses must manage their risks to keep workers safe. In each of these cases there was a failure to follow basic machine safety standards. WorkSafe investigated and prosecuted the cases as part of our role to hold businesses to account when they fall short on health and safety,” says WorkSafe principal inspector Mark Donaghue.

“All three cases are from the manufacturing sector – which has a persistent problem with machine safeguarding and is one of the country’s high-risk industries.”

One worker had two fingers amputated and a third degloved in a punch and shear machine, when the regular machine was out of order at a company in Timaru in January 2022. The business was recently fined $247,500 and ordered to pay reparations of $35,000.

Another worker had three fingers partially amputated while using a punch and forming press at an Auckland company in March 2022. In sentencing, Judge Lisa Tremewan referred to “an unintended complacency” and that “it is critical that robust practices are employed by those within the relevant industries”. A fine of $200,000 was imposed, and reparations of $35,337 were ordered.

And a third worker was cleaning a machine when it amputated two fingers and degloved a third at a company in Auckland in August 2022. The machine’s on/off switch had been knocked into operation because the interlock wasn’t functioning. A fine of $74,392 was imposed, and reparations of $33,000 ordered.

“If you are unsure whether your safeguarding is up to scratch, engage a qualified expert as soon as possible,” says WorkSafe’s Mark Donaghue.

“These sorts of incidents are avoidable. Workers should not be suffering harm like this in 2024, and businesses have no excuse. WorkSafe is notified of machine guarding incidents from across the country every week, and is regularly prohibiting dangerous machinery as part of its proactive and targeted assessments. WorkSafe has a role to influence business to make sure they keep people healthy and safe – that's why we’re speaking out on this issue.”

Workplaces have been required to safeguard machinery since the Machinery Act 1950 took effect. But more than 70 years later, workplaces still aren’t getting it right, with too many workers in Aotearoa being injured and killed from unsafe machinery.

Forklift brake failure incident could have been avoided

Keeping people safe by paying better attention to vehicle maintenance would have saved a worker from a serious forklift injury, WorkSafe New Zealand says. Casey Broad, WorkSafe’s National Manager Investigations, says the $240,000 fine handed down to a company for an incident in September 2022 is a wake-up call to all businesses using forklifts.

“A worker had been collecting rubbish with the forklift. They parked it and put the handbrake on, but when they got out it started to roll down the slope it was parked on.” The 33-year-old tried to recover the forklift but it tipped onto him and caused serious injuries including a punctured lung and broken back.

“WorkSafe’s investigation verified the forklift hadn’t been maintained and serviced to the standard we’d expect. We asked specialists to take a look and what they found was shocking – there were serious safety issues with the handbrake, to the point it would never have been able to stop the forklift from moving even on a slight incline.”

WorkSafe’s Casey Broad says the sentence is a reminder for businesses to keep workers safe. “Businesses must ensure that forklifts and other vehicles and machines are safe to use. If businesses don’t meet their health and safety responsibilities, WorkSafe will hold them to account.”

“A lot of businesses use forklifts, but like any vehicle they need to be serviced and maintained so issues are picked up early and fixed. If you don’t, things can go wrong quickly.”

The company was fined $240,000. Reparations of $62,279 were ordered.

Knowing your Numbers

Knowing your Numbers

In these crazy times of change and uncertainty, it's more important than ever to have a handle on the vital signs of your business – you know, the numbers that keep the engine running smoothly.

Businesses can hit a rough patch just because they're not keeping tabs on those key numbers. Not knowing where your leads are coming from, how well you're turning them into customers, or the value those customers bring, can lead to chaos and a shaky future.

On the flip side, those who stay on top of their numbers are the ones who can spot trends on the horizon and pivot like pros. They're not just surviving; they're thriving.

So, what’s important for a small business?

You should watch your balance sheet ratios – that’s the equity you have in the business. In tougher times, like right now, you should have more equity in your business than in good times. Take the example of a property investor who can rely on increasing property values when times are good. A 20% equity works fine. But when times change you need more, otherwise there’s too much borrowed money and too much interest to pay.

Keep an eye on your KPIs – that’s your key performance indicators. These are things like:

Revenue growth. This measures the increase in revenue over a period of time. It indicates the business’s overall financial performance.

Profit margin. It shows the percentage of revenue remaining after all expenses are deducted, reflecting the efficiency of operations.

New customer cost. Knowing what it costs to get a new customer gives you a good idea of how effective your marketing and sales are.

Customer lifetime value (CLV). This estimates the total revenue a business can expect from a single customer over their lifetime, guiding decisions on customer retention and loyalty programmes.

So, keep your eyes on the prize, stay agile, and remember that with the right insights, your small business can not only weather the storm but come out stronger on the other side!

Interest deductions on Residential Rentals

There have been significant changes to the tax deductibility of interest paid to buy residential rental property.

Previously, subject to certain transitional rules, the interest on money borrowed to buy property where the sale and purchase agreement was dated after the 27 March 2021 was not tax deductible. Limits were imposed on property bought before this date.

The current situation is:

- Year ended 31 March 2024 – 50% of interest is claimable on property where the sale and purchase agreement was dated on or before the 27 March 2021.

- Year ending 31 March 2025 – the cut-off date is dropped and interest deduction is partially allowed for all borrowing. The claim is limited to 80% of the interest incurred.

- Year ending 31 March 2026 onwards – full tax deductibility of interest is restored.

Important: This is not advice. Clients should not act solely on the basis of the material contained in the Tax Talk Newsletter. Items herein are general comments only and do not constitute nor convey advice per se. Changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of the areas. The Tax Talk Newsletter is issued as a helpful guide to our clients and for their private information. Therefore it should be regarded as confidential and should not be made available to any person without our prior approval.